protect your investment.

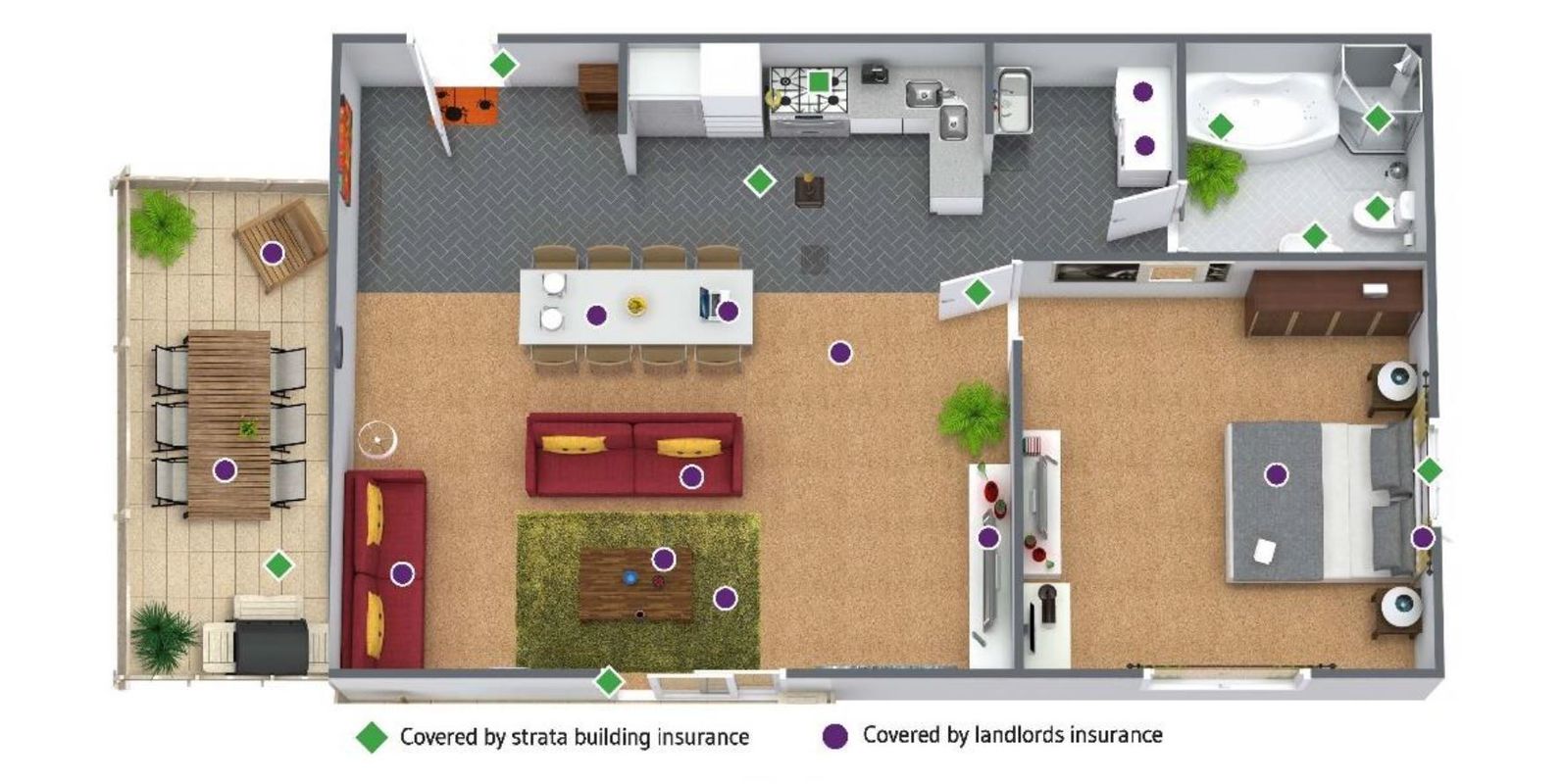

Strata insurance provides general insurance cover for the strata building, shared or ‘common’ areas,

common property and contents as well as liability in the common areas. The cover provided by the strata

building policy often ends when you cross the threshold into of your individual property.

It is important you look at the strata insurance policy purchased by your Strata Company to understand what is and is not covered in your apartment so you can take out the appropriate landlords cover.

1. Understand your risks

Becoming a landlord can be an exciting stage of life but landlords face a series of risks including:

- Accidental damage to contents you own like lighting, carpets, kitchen and electrical appliances

- Malicious damage by tenants or even burglars

- Damage from fire, floods and storms within your apartment

- Loss of rent while the apartment is being repaired after a claim

- Legal liability for injury in your apartment

Landlords insurance is designed to cover your risks as an owner in strata.

2. There are savings in strata

Some landlords insurance is designed for houses so you can end up paying for things you don’t need. A good way to spot this type of policy is wording like “Building insurance for landlords” - your building is normally covered by strata insurance so you don’t need this!

A better way is to have a landlords policy specially designed for strata from companies like CHU. A good landlords policy for strata will start where the strata insurance stops so you get value for money.

3. Airbnb and short term rental cover

This might sound obvious but short term rental is growing in popularity. It is worth checking that it is covered by your landlords insurance.

You may not be planning for short term rental now but the rental market changes and it’s simpler to have it covered in your landlords insurance. Flexibility rules!

4. Tenancy laws

State tenancy laws tend to favour tenants. And there is no sign of that changing any time soon.

Sometimes we focus so much on laws that we forget that landlords can still have very positive results! Landlords insurance covers some of your risks.

5. Why did you decide to be a landlord?

It wasn’t because you wanted more headaches, was it? When you think that landlords insurance is really covering your financial results, it is so worth it.

What is the value of peace of mind? Priceless.

CHU Landlords Insurance for Strata policy covers the cost of accidental or malicious damage to your property, theft, the cost of repairing or replacing damaged contents such as furniture, furnishings, curtains, carpets and internal blinds. Should you become legally responsible to pay compensation for personal injury or property damage, the sum insured is up to $30 million. This product caters to a versatile range of property owners including landlords of long term and short term rentals.

This article was supplied by CHU Underwriting Agencies Pty Ltd

Important note:

CHU Underwriting Agencies Pty Ltd (ABN 18 001 580 070, AFS Licence No: 243261) acts under a binding authority as agent of the insurer QBE Insurance (Australia) Limited (ABN 78 003 191 035, AFS Licence No: 239545). Any advice in this article is general advice only and has been prepared without taking into account your objectives, financial situation or needs. Before making a decision to purchase a product we recommend you consider whether it is appropriate for your circumstances and read the PDS. A copy of the CHU Landlords Insurance for Strata PDS can be obtained by contacting CHU on 1300 361 263 or visiting www.chu.com.au.